What to Do With Your First $10,000 in Savings (Step-by-Step Guide for Beginners)

Hitting $10,000 in savings is a huge milestone. It means you’ve moved past living paycheck to paycheck. You have options now. You can breathe a little easier. And you might be wondering: What do I do next? Should I invest it? Pay off debt? Just keep saving?

When I hit that milestone, I was 30 years old, living in one of the most expensive cities in the U.S. My wife and I had just had our first child. That moment shifted everything for me. I went from chasing short-term wins to thinking about long-term freedom. That $10,000 was the turning point.

Here’s what I wish someone had told me then—broken down step-by-step.

Step 1: Build or Top Off Your Emergency Fund

Goal: $3,000–$6,000

If you don’t already have an emergency fund, this is priority #1. Life throws curveballs—car repairs, medical bills, job layoffs. You want to be ready.

I kept about $5,000 in a money market fund that earned 3–4% interest. Not life-changing, but it was accessible, safe, and gave me peace of mind.

Tool I used: Schwab SWVXX – no fees, easy to automate transfers.

Step 2: Max Out Any “Free Money”

Goal: Grab employer match or use a Roth IRA

If your employer offers a 401(k) match, contribute at least enough to get it. That’s a guaranteed 100% return. If not, or if you have more to invest, open a Roth IRA.

That’s what I did next. Roth IRAs let your money grow tax-free. You can withdraw what you put in at any time. And once you start earning more, that tax-free growth becomes a superpower.

Where I started: I opened a Roth IRA with Schwab because I already had a checking account with them and bought a total stock market ETF.

Step 3: Invest in a Total Stock Market ETF

Goal: Grow your money over time

After your emergency fund and retirement basics are covered, the next step is to invest. My go-to advice? Put what’s left in a low-cost total stock market ETF.

If that sounds like jargon, it’s not. It’s just a way to buy a tiny slice of every major U.S. company. You’re not gambling on one stock—you’re owning the market.

This is still where most of my money goes today.

📘 Read next: What’s an Index Fund?

📘 Read next: If You Only Do One Thing—Invest in a Total Stock Market ETF

Step 4 (Optional): Explore Higher-Risk, Higher-Reward Options

If you’ve done all the above and still have money left, consider putting a small percentage into higher-growth opportunities—like individual stocks, real estate, or even starting a side business.

Personally, once I had my base covered, I started investing in rental properties and eventually turned one into an Airbnb. It’s not for everyone, but it helped me build real wealth faster.

📘 Related: How I Knew I Was Ready for High-Risk, High-Return Investments

Mistakes I Almost Made (So You Don’t Have To)

- Leaving it all in a checking account (inflation eats it)

- Buying random stocks with no plan

- Trying to “wait for the dip” instead of starting now

- Ignoring retirement accounts because I “wasn’t old”

Your First $10K Isn’t Just About the Money

It’s about momentum. It’s proof you can do this. You don’t need to be rich to start investing—but you do need to start. That’s how you stop trading time for money. That’s how you buy back your future.

Ready to Start?

Here’s my step-by-step guide to making your first $100 investment.

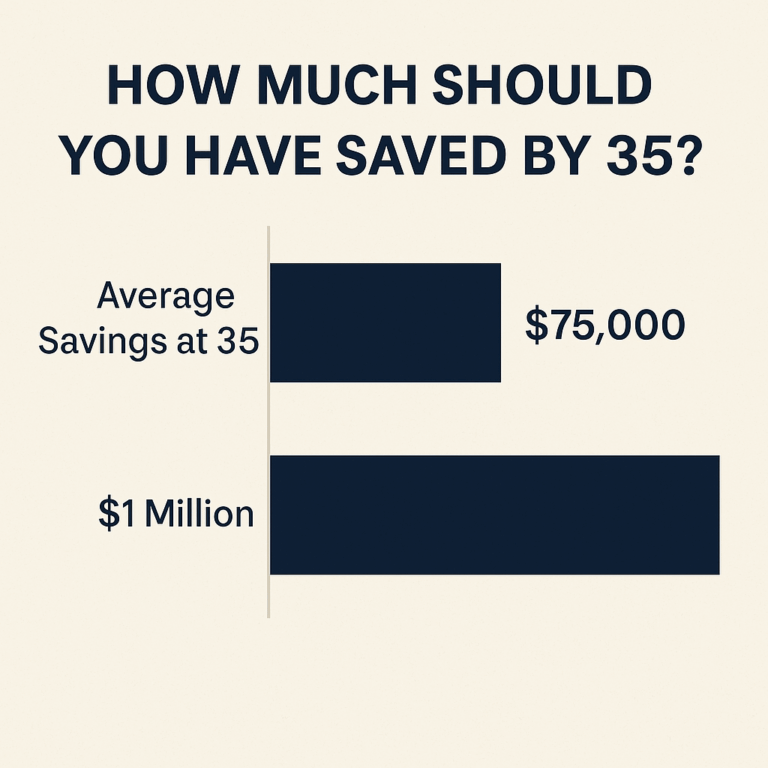

How Much Should You Save at 35? (Here’s What I Did)

The Short Answer: It Depends. But Let Me Tell You What Worked for Me. When I turned 35, I had…

From $0 to $1 Million by 35: A Simple Wealth-Building Strategy

TL/DR: I worked hard to steadily increase my income over time until I could save half of it every month…

If You Only Do One Thing — Invest $100 In a Total Stock Market ETF

If you’re feeling overwhelmed about investing and don’t know where to start, let me make it dead simple: Open a…

10 Easy Things You Can Do Right Now To Start Investing

You don’t need a finance degree or a trust fund to start investing—you just need a plan and a few…

Is It Too Late to Start Investing at 30? Not Even Close.

Spoiler: I started with nothing and still built a $1 million net worth by 35. If you’re in your late…

Is $5,000 a Good Salary?

If you’re earning $5,000 a month, you might be wondering: Is $5,000 a good salary?The short answer is — it depends on your…

Average Net Worth by Age 30 (And How to Beat It)

Wondering where you stand financially?Let’s talk about the average net worth by age 30 — and, more importantly, how you can blow past…

How to Invest $100 a Month (Even If You’re Just Getting Started)

Think you need a lot of money to start investing?Think again.Even $100 a month can build real wealth over time — if you…

What Is a Money Market Fund? (And When Should You Use One?)

If you’re just getting started with investing, you might have heard the term “money market fund” tossed around. It sounds a little…