What Is a Money Market Fund? (And When Should You Use One?)

If you’re just getting started with investing, you might have heard the term “money market fund” tossed around. It sounds a little like a savings account, a little like investing—and honestly, it confused me at first too.

So let’s break it down in plain English:

What is a money market fund? How does it work? Is it safe? And when should you actually use one?

💡 What Is a Money Market Fund?

A money market fund is a type of mutual fund that invests in very short-term, low-risk financial assets. Think government Treasury bills, certificates of deposit (CDs), and corporate commercial paper.

It’s designed to do one thing really well:

👉 Protect your money while earning a small return.

You’ll often see money market funds used as a “parking lot” for cash you want safe and accessible—but not sitting idle in a checking account.

🧠 Money Market Fund vs. Savings Account

Here’s a quick breakdown:

| Feature | Money Market Fund | High-Yield Savings Account |

|---|---|---|

| Return | Often slightly higher | Often lower (but guaranteed) |

| Liquidity | Same-day or next-day access | Instant |

| Risk | Very low, but not zero | FDIC-insured (up to $250k) |

| Where to Open | Brokerage (Schwab, Vanguard) | Bank (Ally, SoFi, etc.) |

| Best For | Investors moving cash around | Everyday savers |

✅ Pro tip: Money market funds are different from money market accounts (which are more like savings accounts). Don’t mix them up!

🔐 Are Money Market Funds Safe?

They’re considered one of the safest investment options available—just below cash in terms of risk. But they’re not FDIC-insured like a bank account. Instead, they aim to maintain a stable $1/share price while earning small interest returns.

In rare cases (like the 2008 financial crisis), some money market funds “broke the buck”—but it’s extremely rare, and reforms since then have made funds even safer.

💰 What Kind of Returns Can You Expect?

In early 2024–2025, money market funds have been earning 4.5% to 5.25%, thanks to high interest rates. That’s higher than many savings accounts—and a great option for holding cash short-term.

Returns will fluctuate as interest rates rise or fall, but they’re usually better than leaving your money in a checking account doing nothing.

🧭 When Should You Use a Money Market Fund?

Here are three great use cases:

1. Emergency Fund (Partially)

Keep 3–6 months of expenses safe but growing. I personally split my emergency fund between a savings account (for instant access) and a money market fund (for higher yield).

2. Waiting to Invest

Let’s say you’re saving up for a home down payment, or waiting for your next investing move. A money market fund earns something while you wait—without big risks.

3. Your Brokerage Cash

When you transfer money into your brokerage account (Schwab, Fidelity, Vanguard), it usually lands in a money market sweep fund by default. You can leave it there while deciding what to invest in.

🏁 Final Thoughts: Should You Use One?

If you’re sitting on a chunk of cash and want a safe, liquid place to store it—yes, a money market fund is a great tool.

It won’t build long-term wealth like index funds or real estate, but it plays an important role in your financial toolkit. Especially now, with interest rates high, it’s one of the best places to earn solid returns on your cash.

Want to know how to balance money market funds, stocks, and bonds in your portfolio?

📘 Read next: How to Decide Between Bonds, Cash, or Stocks

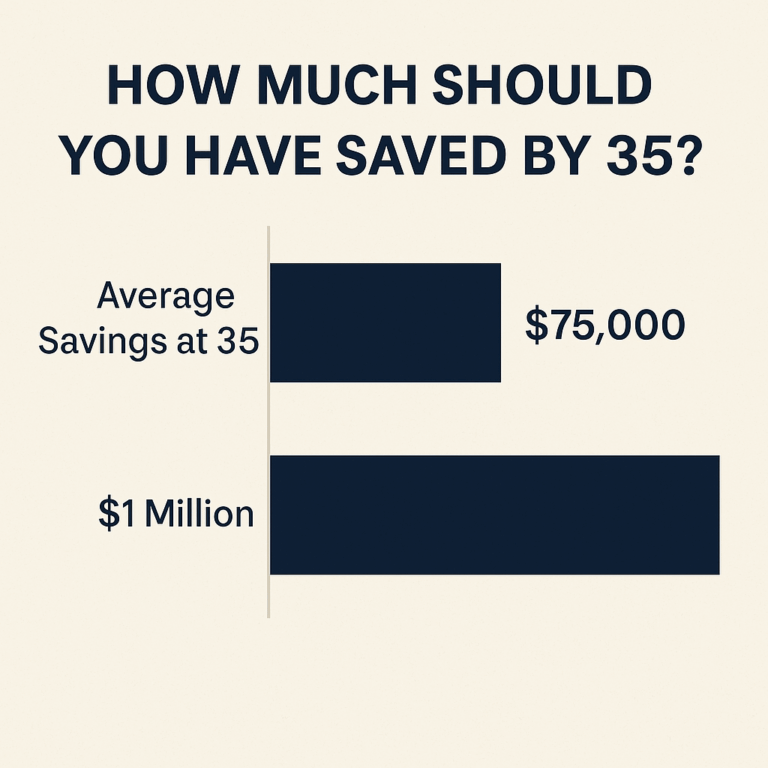

How Much Should You Save at 35? (Here’s What I Did)

The Short Answer: It Depends. But Let Me Tell You What Worked for Me. When I turned 35, I had…

From $0 to $1 Million by 35: A Simple Wealth-Building Strategy

TL/DR: I worked hard to steadily increase my income over time until I could save half of it every month…

If You Only Do One Thing — Invest $100 In a Total Stock Market ETF

If you’re feeling overwhelmed about investing and don’t know where to start, let me make it dead simple: Open a…

10 Easy Things You Can Do Right Now To Start Investing

You don’t need a finance degree or a trust fund to start investing—you just need a plan and a few…

What to Do With Your First $10,000 in Savings (Step-by-Step Guide for Beginners)

Hitting $10,000 in savings is a huge milestone. It means you’ve moved past living paycheck to paycheck. You have options…

Is It Too Late to Start Investing at 30? Not Even Close.

Spoiler: I started with nothing and still built a $1 million net worth by 35. If you’re in your late…

Is $5,000 a Good Salary?

If you’re earning $5,000 a month, you might be wondering: Is $5,000 a good salary?The short answer is — it depends on your…

Average Net Worth by Age 30 (And How to Beat It)

Wondering where you stand financially?Let’s talk about the average net worth by age 30 — and, more importantly, how you can blow past…

How to Invest $100 a Month (Even If You’re Just Getting Started)

Think you need a lot of money to start investing?Think again.Even $100 a month can build real wealth over time — if you…