Is $5,000 a Good Salary?

If you’re earning $5,000 a month, you might be wondering: Is $5,000 a good salary?

The short answer is — it depends on your location, lifestyle, and financial goals. But for most people, $5,000 a month (or $60,000 a year) is enough to live well, save aggressively, and build long-term wealth — with the right plan.

In this post, we’ll break it down:

- How $5,000 stacks up to national averages

- What kind of lifestyle $5,000 can buy

- How to use a $5,000 salary to start building wealth

How Does $5,000 Compare to the Average Salary?

First, let’s look at the numbers:

According to the U.S. Bureau of Labor Statistics, the median weekly earnings for full-time workers in 2024 were about $1,145 — or roughly $59,540 per year.

Earning $5,000 a month puts you slightly above the national median.

- $5,000/month = $60,000/year

- Slightly above the national median income

- Higher than many entry-level jobs

Of course, averages can be misleading.

Where you live makes a big difference.

Is $5,000 a Good Salary in Your City?

Cost of living varies dramatically between places like New York City and small-town America.

Here’s a rough guide:

| City / Region | $5,000 Salary Lifestyle |

|---|---|

| New York City, NY | Tight budget, likely need roommates |

| Miami, FL | Comfortable but careful living |

| Dallas, TX | Very comfortable living |

| Omaha, NE | High savings potential |

| Rural Areas | Excellent savings + lifestyle |

💡 Rule of thumb:

If your rent is less than 30% of your income (under $1,500/month on $5,000), you’re in a good spot financially.

What Kind of Life Can You Afford on $5,000 a Month?

If you manage your money smartly, $5,000 can go a long way.

Here’s an example monthly budget:

| Category | Budget Amount |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities/Internet | $200 |

| Groceries | $400 |

| Transportation | $300 |

| Health Insurance | $200 |

| Entertainment/Fun | $300 |

| Travel Savings | $200 |

| Emergency Fund | $200 |

| Retirement Savings | $500 |

| Investment Savings | $500 |

| Miscellaneous | $200 |

Total: $4,000

Leftover: $1,000 buffer

With smart budgeting, you can cover essentials, enjoy life, and save at least 20%–30% of your income.

How to Turn a $5,000 Salary Into Wealth

Earning $5,000 a month is more than enough to start building serious wealth — if you’re intentional.

Here’s a simple plan:

1. Save and Invest Early

The earlier you start, the easier it gets.

Example:

- Invest $500/month in a Total Stock Market ETF (like VTI or SCHB)

- After 20 years at 8% average returns, you could have over $275,000.

2. Avoid Lifestyle Creep

Just because you can afford a fancier car or bigger apartment doesn’t mean you should.

Keeping your living costs stable is the #1 way to save and invest more over time.

3. Build an Emergency Fund

Aim for 3–6 months of living expenses.

This protects you from job loss, medical emergencies, or unexpected expenses without going into debt.

4. Max Out Tax-Advantaged Accounts

Prioritize:

- 401(k) contributions (especially if there’s a match)

- Roth IRA or Traditional IRA

- HSA if you have a high-deductible health plan

These accounts lower your taxes and grow your investments faster.

Is $5,000 Enough to Live Comfortably?

Yes — if you manage it wisely.

You can:

- Rent a nice apartment (or share a larger space)

- Own a reliable used car (no debt if possible)

- Travel occasionally

- Build real savings

But in high-cost-of-living cities, you’ll need to budget tightly or consider moving if your long-term goal is financial independence.

Final Thoughts: Is $5,000 a Good Salary?

Earning $5,000 a month is a great starting point.

You’re already ahead of many Americans — and with a simple, disciplined strategy, you can build wealth, travel, and live well without financial stress.

At the end of the day, it’s not just how much you earn — it’s what you do with it that matters.

👉 Next step: Learn how to invest your first $100 right here!

How I Invest My $200,000 Salary (Step-by-Step Breakdown)

I Make $200,000 a Year — Here’s How I Invest It I wasn’t always a high earner. My first job…

Weekly vs Monthly Investing: Which Is Better for Beginners?

If you’re wondering whether to invest weekly or monthly, you’re not alone.One of the most common beginner questions I get…

Saving vs Investing: What Should You Do First?

If you’re just getting started with money, you’ve probably asked this question: Should I save first, or start investing right…

What to Do With Your First $1,000

When I had my first $1,000 saved, I felt two things at once: proud…and stuck. I knew I should do something…

What Is Dollar-Cost Averaging? (And Why It Works So Well for Beginners)

We started investing in 2013, right after I landed my first “real” job — $15 an hour, entry-level. My wife…

How to Get Rich From Nothing (Even If You’re Broke Right Now)

I started with nothing. No inheritance. No stock tips. No trust fund. My parents didn’t leave me a dime, and…

The Best First Investments for Kids (And How I’m Building Generational Wealth for My Daughter)

When I was growing up, no one handed me a roadmap to building wealth. My parents weren’t investors. They didn’t…

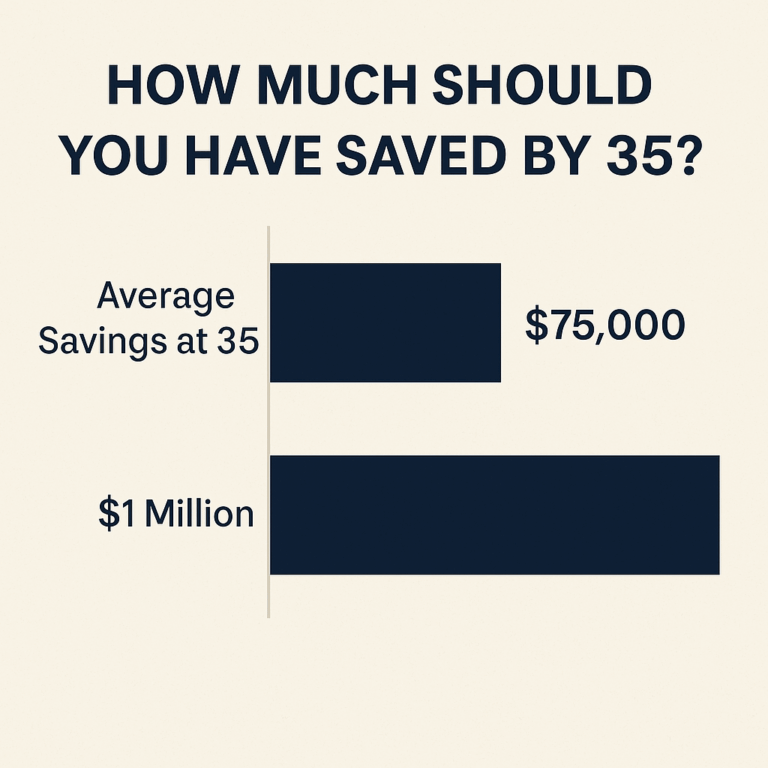

How Much Should You Save at 35? (Here’s What I Did)

The Short Answer: It Depends. But Let Me Tell You What Worked for Me. When I turned 35, I had…

From $0 to $1 Million by 35: A Simple Wealth-Building Strategy

TL/DR: I worked hard to steadily increase my income over time until I could save half of it every month…